At SCL, we are well positioned to evolve and operate in a scenario that is expected to witness large-scale future demand, despite current challenges. We are confident of our intrinsic capabilities and the strategies that we have put in place for the next orbit of growth and sustainability.

Professional management with strong execution track record

At SCL, our operations and strategy are driven by well-qualified and well-experienced senior management personnel. We are also actively guided by our distinguished Board, which sets our overall organisational direction and evaluates the holistic progress of the organisation against its strategic focus areas.

The strengths of our management

Encouraging financial, operational and ESG performance

Review our operational and financial performance

A well-timed and prudent strategic expansion plan

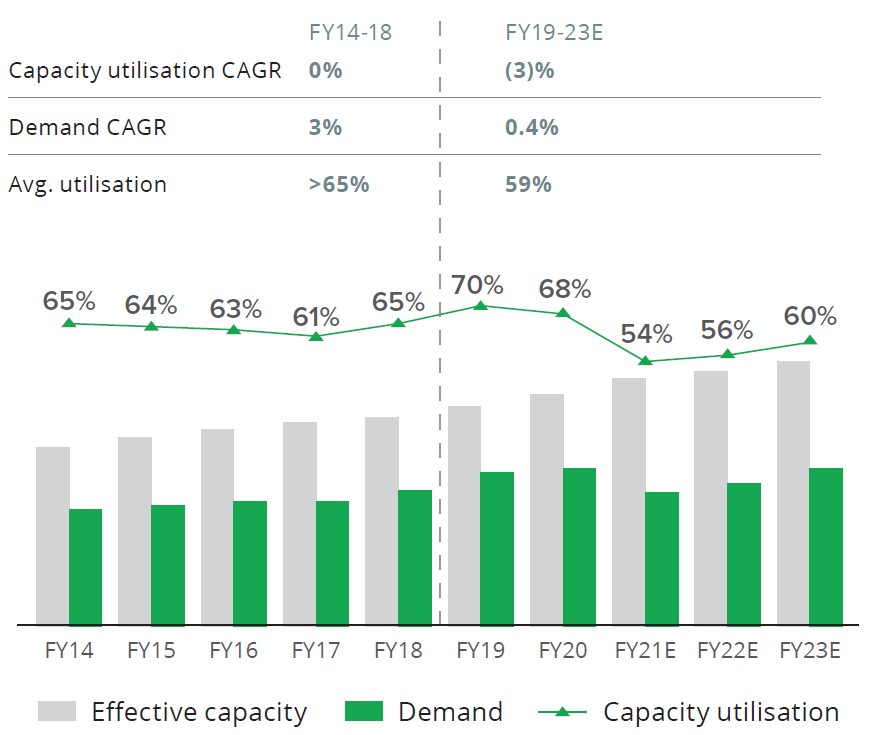

In India, the cement industry demand oscillates every five to six years between the up and down cycles. The last up cycle commenced in FY2016 and is expected to continue at least until FY2021. We are capturing this buoyancy in demand with our recently acquired SCRL and Bayyavaram units with superior access and short lead distance to increase profitability, while reducing Scope 3 emissions.

We are also deepening our market presence in the Eastern belt with the Bayyavaram grinding unit’s strategic location (of being close to the market and having slag available locally), and clinker availability from the mother plant at Mattampally.

Cement demand cycle movement between FY2014 and FY2023 (E)

Note: Cement demand in MTPA

Ready to capture the demand revival in South India

The South Indian market has seen a declining demand scenario until recently, leading to the prevalence of excess production capacities and stunted capacity utilisation levels. However, post the formation of the state of Telangana and the announcements of various infrastructure scheme, demand revival is inevitable, with large-scale opportunities for players like SCL.

In the period between FY2017 and FY2021, the expected demand growth is around 5-6%, while the capacity addition CAGR will be to the tune of 2.8%. This directly contributes to better capacity utilisation levels at around 60% in the coming three years for the existing cement manufacturers in the region.

Demand, capacity and utilisation levels between FY2014 and FY2023 (E)

SCL is ready to serve the upcoming demand with strong production and marketing presence

Synergies from acquisitions to drive multiple benefits

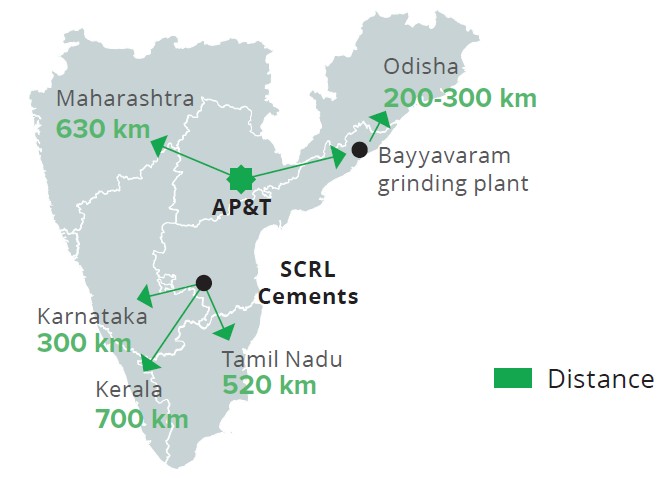

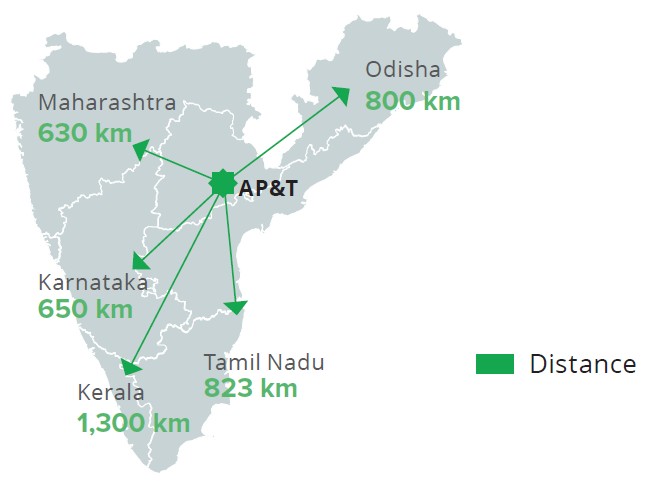

Our strategic acquisition of SCRL and Bayyavaram plants, in FY2016 and FY2017, respectively, were a shot in the arm to achieve market access and cost advantages.

The SCRL acquisition, leading to better access and significant costs synergies, will act as the key catalyst for SCL to emerge as a strong force in the southern markets with superior lead distance factor. The Bayyavaram unit, on the other hand, acts as a vehicle for accessing the eastern markets, starting with southern Odisha. It also drives demand for clinker from our Mattampally plant, which is grinded at the Bayyavaram unit.

Market access and lead distance pre and post acquisitions

Pre acquisitions

Post acquisitions