![]() YoY growth

YoY growth

![]() YoY decline

YoY decline

We have been undertaking a host of initiatives across various ESG parameters. We believe integrating sustainability objectives into

Financial capital

Manufactured capital

Intellectual capital

Human capital

Social and relationship capital

Natural capital

Pool of funds allocated and utilised for all business activities.

Total Equity: ` 1,68,893 Lakhs

Total Debt: ` 1,47,212 Lakhs

Capital commitment as on Mar 2023: ` 8,563 Lakhs

Assets built or owned that facilitate production, storage and delivery of goods.

Cement and grinding plants: 7

Captive power plants: 3

Hydro power plants: 2

Limestone resources: 828.10 MnT

Organisation’s all intangible assets that contributes to its bottom line.

R&D investment: ` 30 Lakhs

Digitisation cost: ` 59 Lakhs

Use of robotics in plant operations: 4.0

Talent acquired and nurtured to manage all business activities.

Employee strength: 2,907

Total employee expense: ` 9,934 Lakhs

Total training hours: 52,390

Building trusted partnerships with key stakeholder groups.

CSR Spent: ` 306 Lakhs

Distributors/Dealers: 2,675

Resources provided by the natural world that are impacted due to business operations.

Total Energy consumed 10,811 TJ

Limestone Mined 4.92 MnT

Slag consumed 0.36 MnT

Gypsum consumed 0.15 MnT

Fly ash consumed 0.58 MnT

Coal Consumed 0.48 MnT

Fresh water withdrawal 2 44 441 KL

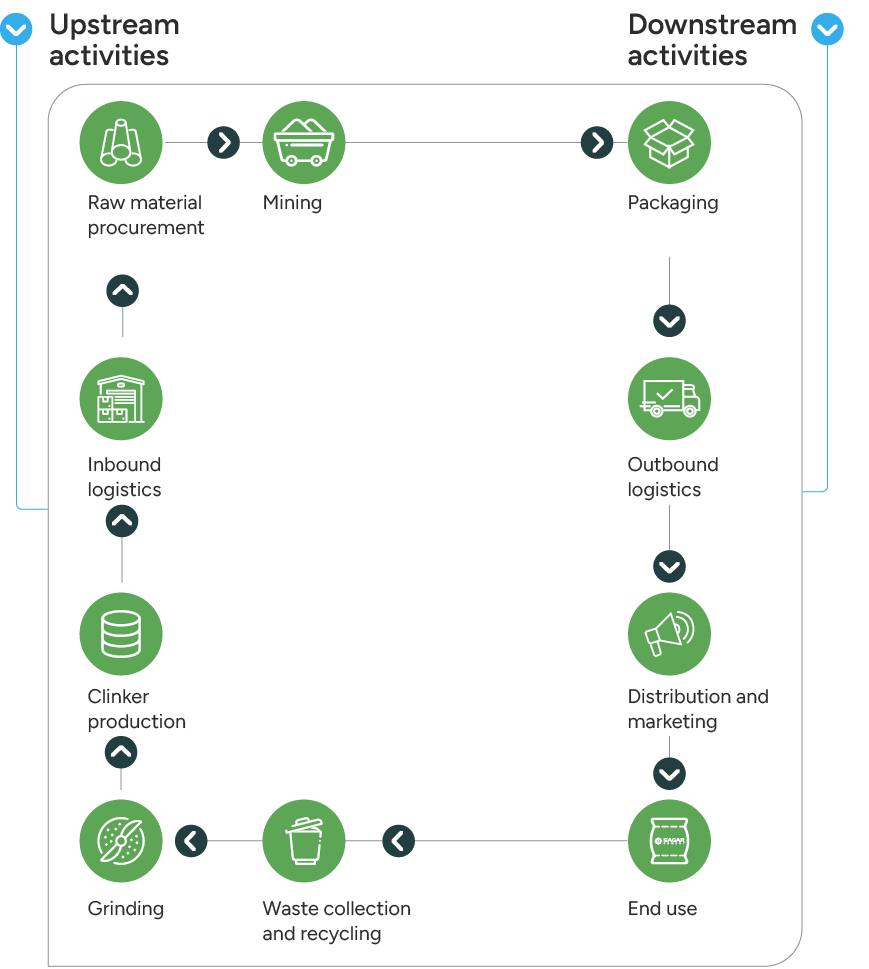

Human resources and administration

Research and development

Secretarial and legal

Finance and accounts

Energy management

IT and digital

Quality

Environment management

Ordinary Portland Cement (OPC)

Portland Pozzolana Cement (PPC)

Portland Slag Cement (PSC)

Sulphate Resistant Cement (SRC)

Composite Cement (CC)

Ground Granulated Blast-furnace Slag (GGBS)

Clinker Production

Steel scrap

Tyres, oil, grease and others

Financial capital

Manufactured capital

Intellectual capital

Human capital

Social and relationship capital

Natural capital

Revenue: ` 2,22,954 Lakhs

PAT: ` 850 Lakhs

RoCE: 8%

Dividend: 35%

Market Capitalisation: ` 2,48,018 Lakhs

Capacity utilisation: 58%

Clinker factor: 75%

Production of high margin products:50%

New products launched: 2

Blended cement produced: 22,86,946 MT

Process improvement achieved – TSR ratio, blended cement volumes:23,83,242 MT

LTIFR: 1.6

Retention rate: 83.47%

Fatalities: 0

Employee productivity: 0.67 ton/manhour

Training hour: 52,390

CSR beneficiaries: 69,629

Number of complaint received: NA

Number of complaint resolved: NA

India ratings: IND A/Stable

Contribution to exchequer: ` 79,228 Lakhs

Total Waste recycled: 10,24,507 MT

Total Water recycled: 80,653 KL

Waste to landfill: 0 MT

Water positive: 6.8 times